Despite having a greater mobile phone and Internet penetration rate than many other countries, Taiwan has extremely few online transactions. Only 5.3% of all retail sales in 2019 were made through e-commerce, and 42.8% of the population has used it. One of the advanced markets with one of the lowest shares of online retailing.

However, there are a number of causes behind this. The first is that it has had a pretty full urbanisation. Therefore, the need for e-commerce is typically low because the vast majority of residents can access supermarkets, convenience stores by foot. The ubiquity of motorcycles also makes grocery shopping convenient. In contrast to people in other nations, Taiwanese prefer to purchase food from street vendors, night markets, and snack shops. Most consumers prioritise dining al fresco. As a result, compared to other economies with comparable economies, the percentage of e-commerce turnover in grocery is quite low. Over the past three years, the market for food delivery has actively grown to include night markets and snack bars.

The third factor is, Taiwan’s retail business has been very sluggish to adopt digital technology in comparison to other economies. This has left a significant market gap. However, over the past five years, several retailers have made significant investments in digitalization, e-commerce, and consumer interaction through digital media, which has also resulted in a significant rise in sales.

Although Taiwan escaped a widespread infection during the early stages of the epidemic, the island’s epidemic management measures (interior usage restrictions and isolation policy) also encouraged more consumers to attempt delivery, furthering the development of many consumers’ e-commerce habits.

Online Shopping

About 9.5% of all retail sales in Taiwan joined e-commerce in 2022, and percentage is predicted to increase to 11.7% by 2026. The global e-commerce market was worth 652.4 billion Taiwanese dollars, or 23.2 billion US dollars.

According to the most recent data (June-September 2022), Shopee dominates the Taiwanese e-commerce market with 44.83% of the total traffic. However, as a result of how it operates, it generates significantly less money in Taiwan than a number of significant rivals.

The anticipated revenue of Shopee is between 30 billion and 45 billion, which is less than that of MOMO and PC Home and somewhat greater than that of Dongsen, despite the fact that the parent business of Shopee did not independently publish revenue in Taiwan.

Major e-commerce sites like MOMO, PC Home, and Eastern Home Shopping have all seen double-digit growth in Taiwan dollars over the previous five years, which is a significant increase. Because MOMO outperformed PC Home in 2016, its revenue will continue to be consistent in 2021. The champion saw a decline in overall income to 88.4 billion Taiwan dollars, or around 23.11% of all e-commerce sales.

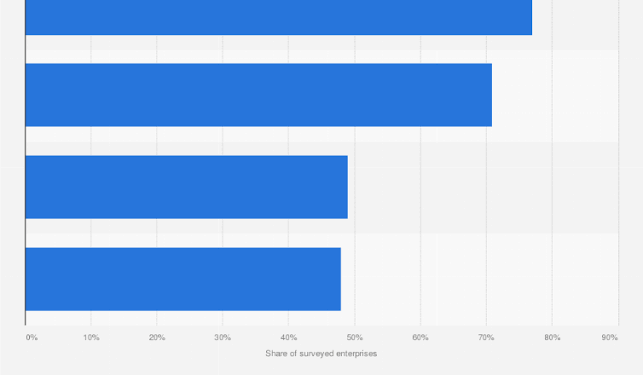

42.8% of consumers make online purchases

74.4% of individuals use debit cards, compared to 53.5% who use credit cards. Only 32.6% of people have online banking accounts, despite the fact that 42.8% of online purchases are made by consumers.

Weekly Purchases in Taiwan

Taiwanese users of e-commerce make weekly purchases:

63.8% Citizens Purchase Products & Services Through Online Channels Every Week

34.7% Purchase Groceries Online Every Week

13.9% Purchase Second-hand products Every Week

38.6% Use Price Comparing Website Every Week

7.9% Use BNLP Every Week

Taiwan has consumers of consumer goods e-commerce who will spend a total of around USD in 2021. This results in an estimated USD per capita expenditure on online retail of consumer products. Additionally, among those who shop online,% of them do so using a mobile device.